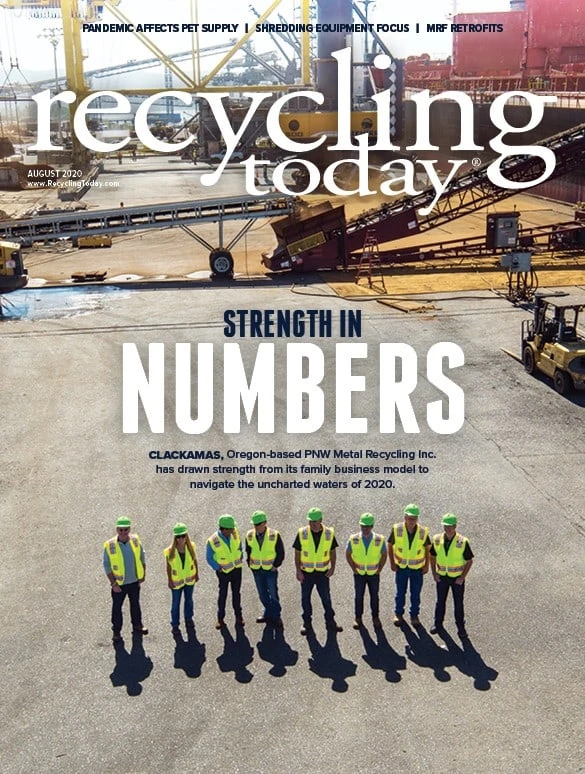

Photo courtesy of PNW Metal Recycling Incl

Even as COVID-19, the disease caused by the novel coronavirus, shut down large parts of the People’s Republic of China in late January and early February, business owners in the United States did not necessarily think their future would come to mimic China’s circumstances.

Several weeks later, the co-owners of Clackamas, Oregon-based PNW Metal Recycling Inc.—like their counterparts throughout the U.S.—were dealing with workplace restrictions, health and safety issues and severe supply depletions.

“COVID-19 has definitely given its challenges to companies all over the world,” says Sean Daoud, a vice president at PNW. As part of one of the three families that owns PNW, Daoud says the combined experience and commitment to certain core qualities shared by the company’s co-owners have helped it navigate the unprecedented circumstances of the 2020 economy.

Combined to compete

PNW Metal Recycling is a fairly new name to the scrap industry, but only because it was created in 2017 by the merger of two existing family businesses: Rivergate Scrap Metals and R.S. Davis Recycling. Both of those companies were based in Oregon and had been cooperating on a joint venture basis since 2013.

“R.S. Davis was owned by the Doane family, and Rivergate was owned by the Bors and Daoud families,” Sean says. “The founding members of each business had been operating metal recycling businesses for decades, and the next-generation members grew up in the business and have worked side by side with their parents from a young age.”

Sean says the varying backgrounds and work experience of members of all three families provide a “strength in numbers” aspect to the leadership team of PNW.

“Some members have worked outside of the company at publicly traded companies and brought a wealth of knowledge with them when they joined the business,” Sean says. “Other members have worked in the family business since they were physically capable. All have learned the industry and the business from the ground up. The depth of knowledge and skillsets of each member is a direct link to the success the companies have had and will be a driving factor toward the successful growth to the next level,” he adds.

On the depth of experience front, Sean says, “These families have been in the business for decades and have over 200 years of combined experience.”

The newly combined PNW has seven locations—six in Oregon and a facility in Longview, Washington. In Longview, PNW loads ferrous scrap for bulk export sales. The company operates an auto shredder and a wire chopping line in Portland, Oregon. “Our Clackamas, Oregon, location is our headquarters and where our administrative offices are located,” Sean says.

The company focuses regionally in terms of its scrap procurement. “We buy from the Pacific Northwest region mainly, hence our business name of PNW Metal Recycling,” Sean notes.

It is more global on the sales side, with some of its ferrous scrap heading in bulk shipments to buyers in Southeast Asia and nonferrous scrap heading to buyers all over the world. “Our markets are mainly export-based mills in Asia, but we also sell to domestic mills,” Sean says.

Knowing who and why

In addition to combined know-how and processing capacity, the merger that created PNW has led to a company with a wider network of business relationships, says Hank Doane, senior vice president and chief financial officer of PNW.

He says people in the company’s leadership posts unanimously support the idea that scrap recycling is a sector built on the strength and depth of relationships.

“We definitely try to set the bar high when it comes to the relationships we have with our employees, suppliers, customers and vendors,” Hank says. “We want the words trust, ethical, moral and honest connected to our name.”

Market challenges that include regulatory changes declared swiftly by government agencies in China and elsewhere and the onset of the COVID-19 pandemic have made those relationships critical, Sean says. Also critical is the PNW’s leadership team members’ ability to communicate with each other and those beyond the board room.

“We’ve formed a great team within our company to make sure we have safe, healthy, efficient, low-cost, effective, high-quality and highly productive operations,” Sean says.

Strong systems increasingly are essential, Sean adds. “Market conditions are challenging. COVID-19 has hit countries at different times, which has influenced how material flows globally.”

He continues, “We’ve had to adapt our operations not only to meet those expectations our customers have internationally but also to what our local authorities expected for us to continue to operate. We’re an essential business in an essential industry, so we’ve responded to make sure we’re supporting all of the people we have an impact on.”

Smart investments

Business owners planning for the long term face choices in how to control costs while also investing for the future, and Fouad Daoud, president of PNW, says that calculation is front and center at the firm.

He lists “low-cost production” as one of the firm’s top three priorities, along with “relationships and internal team dynamics.” Fouad adds, “The investments we’ve made over the years have helped us lower our operating costs and handle more material efficiently as the landscape of business has changed. We hope these three aspects will help us navigate to the potential we think we’re capable of.”

As a management goal, “We want to continue the trend of being a low-cost operator and expanding our abilities to meet the changing international demand for higher quality products,” he says.

In terms of attention to quality, Sean says, “Certain products we traded to certain countries a few years ago are no longer accepted there. We are investing in equipment to increase our processing capability, with the wire chopper being an obvious investment we made in 2018. We’re also changing and upgrading another system we have that will increase our metal sorting ability.”

Three years removed from the merger that created PNW Metal Recycling, Fouad says it almost certainly was critical to form a larger, stronger firm before trade conflicts and pandemic turmoil began roiling the scrap market and the wider economy.

A 2019 article by Oregon Business, prepared in cooperation with Washington Federal Bank, characterizes the premerger Rivergate Scrap Metals and R.S. Davis Recycling companies as having a “demonstrated history of making sound investments and operating through tough economic cycles. Each of the families built their companies from the ground up.”

That same article states, “In 2017, PNW Metal Recycling posted a record year for growth, revenue and profitability. The company continues to grow year over year, despite difficulties posed by trade tariffs in 2018 that largely closed off the Chinese market for recycling exports. Most importantly, the merger has allowed PNW to make key strategic decisions that have led to increased volumes, lowered costs and a stronger ability to weather volatile market cycles.”

Hank expresses confidence that the strength of PNW’s leadership will see the firm through the changes affecting the scrap recycling sector.

“We’re facing a lot of change in regard to product quality,” Hank says. “PNW has worked hard to strengthen our relationships with customers, suppliers and vendors to make sure our operations are meeting the standards and needs of everyone we do business with. Our team has been organized strategically for our growth and to build upon areas we have strength in—or that need improvement,” he adds.

The leadership team drawn from multiple generations provides additional strength for the future, Sean says. “From a founding generation to help guide with experience to the next generation that has a drive to do more, it is a good group of people that will help take PNW to the next level.”

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the August 2020 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Fenix Parts acquires Assured Auto Parts

- PTR appoints new VP of independent hauler sales

- Updated: Grede to close Alabama foundry

- Leadpoint VP of recycling retires

- Study looks at potential impact of chemical recycling on global plastic pollution

- Foreign Pollution Fee Act addresses unfair trade practices of nonmarket economies

- GFL opens new MRF in Edmonton, Alberta

- MTM Critical Metals secures supply agreement with Dynamic Lifecycle Innovations